Mother & baby

Effective Tips For Teaching Good Habits In Kids

1757645852000

Investing has become more accessible to the masses thanks to technological advancements. Investing apps have emerged as essential tools, streamlining complex processes and empowering users to manage their financial futures directly from their smartphones.

Investing has become more accessible to the masses thanks to technological advancements. Investing apps have emerged as essential tools, streamlining complex processes and empowering users to manage their financial futures directly from their smartphones.

Starting your investing journey involves several specific steps that can help demystify the process. Begin by educating yourself on the basic concepts of investing. You can find numerous online resources, beginner courses, and books that explain stocks, bonds, mutual funds, and the importance of diversification in a straightforward manner.

Once you've grasped the fundamentals, the next step is to choose a platform or app to facilitate your investments. Many beginner-friendly apps offer easy-to-use interfaces, educational tools, and low minimum investment requirements, making them ideal for new investors. Some popular options include Robinhood, Acorns, Stash, and Betterment. These platforms often provide guidance and support, helping you make informed decisions without being overwhelmed.

Start with small investments to gain confidence and understand the market dynamics. Even modest amounts, invested consistently over time, can grow substantially thanks to the power of compounding. Remember, the key is to stay informed, be patient, and keep a long-term perspective.

Keep reading to discover more beginner-friendly investing apps and courses to help you get started on your investment journey.

Enrollment in investment courses can significantly demystify the world of stocks and financial markets, instilling confidence and knowledge in novice investors. Here are several highly recommended courses tailored for beginners:

This introductory course covers essential topics, including stocks, bonds, and mutual funds, making it ideal for beginners seeking a solid foundation in investing principles.

Led by esteemed Professor Robert Shiller, this course offers valuable insights into the operation of financial markets, making it an ideal choice for those seeking an academic perspective.

A practical course centring on stock market fundamentals, with strategies designed for hands-on learners eager to navigate the market efficiently.

This complimentary course offers an introduction to various investment strategies, specifically tailored for individuals just beginning their investment journey.

Completing these courses can dramatically enhance your investing knowledge and skills, setting the stage for informed financial decisions that will serve you well in the future.

Acorns stands out as a transformative investment app that simplifies the investing process. Its unique round-up feature allows users to invest spare change from daily purchases, making the task more approachable, particularly for novices. With Acorns, every rounded-up transaction contributes to a diversified portfolio, enabling users to build wealth over time without the pressure of significant upfront investments.

Robinhood revolutionises the investment landscape by offering commission-free trading through an intuitive interface that attracts many younger investors. Its ease of accessibility demystifies stock trading, inviting a generation eager to engage with financial markets. The integration of innovative features and educational resources empowers users, rendering investing an approachable and exciting venture within today's digital context.

Stash empowers users by enabling them to invest in fractional shares of high-value stocks, breaking down barriers to entry for beginners. This app focuses on education, offering personalised investment options and informative resources that equip users to make confident decisions regarding their financial future, navigating the often complex investment landscape with ease.

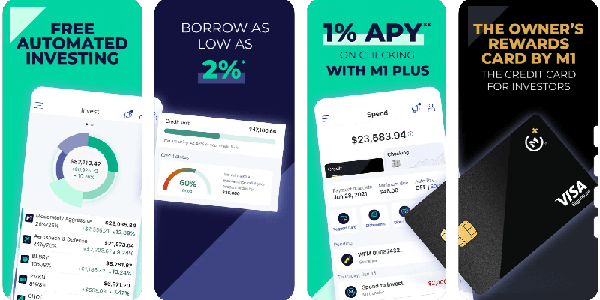

M1 Finance reimagines investing with its innovative pie chart functionality, enabling users to visualise and customise their portfolios easily. This intuitive method simplifies fund allocation across various investments. Additionally, the platform offers automated rebalancing, allowing investors to maintain their desired investment strategies without requiring constant oversight and adjustments.

Coinbase serves as a leading platform for cryptocurrency investment, recognised for its user-friendly interface that eases the trading process. Enhanced security features, such as two-factor authentication and insurance against breaches, position Coinbase as an attractive option for newcomers to the cryptocurrency arena. With substantial growth potential in the crypto space, Coinbase enables users to embark on their investment journey with confidence.

Fundrise presents unique opportunities for investors interested in real estate by facilitating participation in diversified real estate portfolios with minimal hassle. Enabling passive income through monthly dividends and potential capital appreciation, it offers a compelling alternative for those wishing to diversify beyond traditional stock market investments. With Fundrise, users can grow their wealth while enjoying the benefits inherent to real estate ownership.

ETRADE boasts a robust trading platform equipped with a comprehensive suite of tools tailored for serious investors. Its established reputation for reliability and innovative features makes it a top choice for those seeking a powerful trading experience. With advanced analytics alongside educational resources, ETRADE empowers users throughout their investment journeys.

SoFi Invest caters to a diverse range of investment preferences, offering options that include both stocks and ETFs for investors at all experience levels. The platform is enhanced by a robust suite of financial planning resources, enabling users to create strategies tailored uniquely to their goals and risk appetites. This blend of accessibility and support positions SoFi Invest as an excellent choice for anyone eager to cultivate their wealth.

Tastyworks is distinguished by its focus on options trading, providing a wealth of educational resources to support traders of all skill levels. The platform fosters community engagement, enabling investors to collaborate, share strategies, and enhance their trading knowledge together. This collective approach fosters a dynamic and interactive trading environment, enriching the investment journey for participants.

Ally Invest stands out through its commitment to low fees and flexible investment options, offering both self-directed and managed portfolios. Users enjoy exceptional customer support and a myriad of educational resources designed to enhance their investment literacy. This perfect pairing of affordability, adaptability, and user support makes Ally Invest a prime choice for both novice and seasoned investors looking to maximise their financial growth.

The emergence of artificial intelligence (AI) in investing heralds a transformative opportunity for both novice and seasoned investors. AI-powered tools simplify data analysis, helping users enhance their investment strategies while mitigating risks. Here are three leading AI-based investment apps:

Wealthfront utilises AI algorithms to construct and manage personalised investment portfolios. Key offerings include tax-loss harvesting and automated rebalancing, which optimise tax impacts while maintaining target asset allocations.

This app employs AI to provide real-time market assessments and predictive analytics. With its virtual trading simulator, investors can experiment with strategies without financial risk, making it ideal for beginners honing their approaches.

Betterment utilises AI to develop personalised investment plans tailored to individual goals. The app automates savings and investment suggestions, facilitating efficient wealth growth while reducing emotional decision-making, particularly beneficial for novices.

These AI-driven tools are becoming indispensable for modern investors, encouraging informed decision-making amid a complex market landscape.

In summary, the advantages of utilising investing apps for wealth cultivation are clear, offering the convenience of accessibility and personalised support. As you assess your investment objectives, consider which app best aligns with your aspirations to enhance your potential for success. Don't hesitate—initiate your investment journey today and take the first bold step toward securing a brighter, wealthier future.

Do you like this article?

Mother & baby

1757645852000

Fashion

1757645952000

Fashion

1757645952000

Fashion

1757645952000

Career & Education

1757645874000

Career & Education

1757645873000

Mother & baby

1757645852000

General Finance

1757645995000

Mother & baby

1757645852000

Mother & baby

1757645852000